BRIDGING THE GAP

Charitable Remainder Unitrust – an Overview of an Important Financial Planning Tool

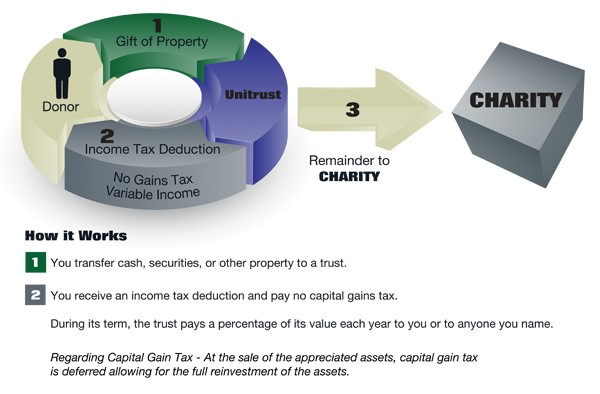

The charitable remainder unitrust is a vehicle that is making a comeback after having gone out of favor. A CRUT is an irrevocable trust that can help you reach your financial goals by:

1. Providing income.

2. Save taxes.

3. Enhance diversification of concentrated, highly appreciated, or illiquid assets.

4. Give money to charity

5. Eliminate the provisions of the 10-year required distribution of a beneficiary IRA (bring back the “Stretch IRA.”

For those with high tax burdens who are charitably minded, a CRUT can be a tool that serves many purposes.

A unique characteristic of a CRUT is that – unlike a donor advised fund – the trust distributes income to named beneficiaries. These beneficiaries are usually either the grantor (the person setting up the trust) or members of the grantor’s family. This can pass through a generation – start with the grantor and continue to the grantor’s wife, children, or grandchildren, for example.

The Typical Donor:

Needs income for life or a specified term of years.

Desires more income as the trust value increases.

Desires tax deductions.

Tolerates some investment risk to provide for growth.

Wants to make additional gifts to the trust.

Has illiquid or highly appreciated assets and desires diversification.

Is between the ages of 55 and 80.

The ending amount that is passed to the charity must be at least 10% of the initial value of the assets that were granted to the trust. That also allows the grantor to take an immediate tax write-off of that 10% value.

Benefits of CRUTs

Income for life (variable payments)

Charitable income tax deduction

Possibility of multiple beneficiaries

Assets transferred to the trust can be reinvested

Ability to choose the trustee (may be the donor)

Flexible investment possibilities for the beneficiary

There are several types of Charitable Remainder Unitrusts, and which type depends on how income will be distributed. Here are the main types of CRUTs:

1. Standard Unitrust – This provides a standard income that is fixed based on when you set-up the trust. The percentage is fixed when the trust is set-up, and must be greater than 5% but less than 50%. The asset is valued at year-end and the percentage is multiplied by the asset valuation to determine the payout.

2. Net Income Unitrust – this type of trust provides annual payments that might follow the same process as a standard unitrust, but also has the option to pay the total net income of the assets in the trust, whichever is lower. Younger donors or those who are looking to defer payments until later in life may choose this type of trust.

3. Flip Unitrust – this trust begins as a net income unitrust, but only pays beneficiaries on actual earnings of the trust. A flip unitrust is most often chosen when an illiquid investment, such as real estate or artwork, is used to fund the trust.

Here are a few examples of how a CRUT could be used.

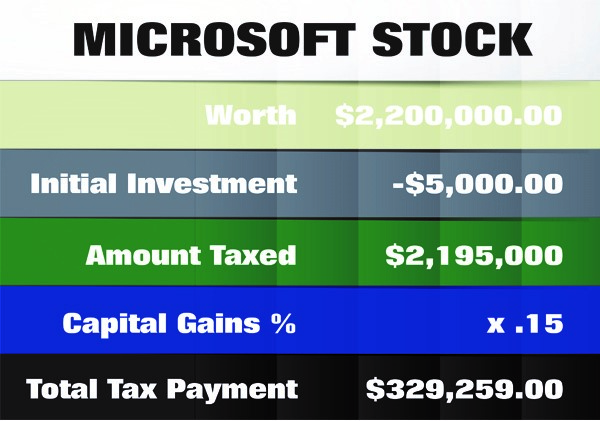

1. Colin has owned Microsoft stock for thirty years. The stock has appreciated demonstrably, and his initial $5,000 investment is worth $2,200,000. Since Colin’s current income is $250,000/year, his capital gains tax rate will be 15%. That will mean that if Colin sells his stock, he will need to pay

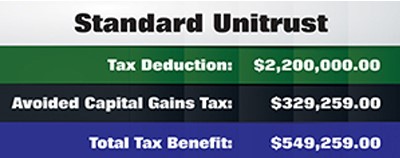

However, if Colin puts together a CRUT as a standard unitrust, he takes an immediate tax deduction for 10% of the initial $2,200,000 ($220,000), AND avoids paying the immediate capital gains tax of $329,259.

The CRUT can sell the Microsoft stock and invest in a diversified portfolio of Colin’s choosing, and pay Colin 5% of the total value of the portfolio annually (resulting in approximately $110,000/year in income, depending on the value of the portfolio over time).

Colin chooses the charitable beneficiary, and is now able to give a sizeable donation to that charity at the end of the CRUT.

2. Pam is aware of the elimination of the stretch IRA. She is 75 years old and has about $2,000,000 in an IRA that she would like to leave to her son Benjamin. However, Benjamin makes $250,000/year, and taking an additional $200,000/year or more in income would push him into the 35% tax bracket from the 24% tax bracket.

This would result in him paying an additional $27,500 in taxes on his own income, PLUS $75,000 in taxes on the income from the beneficiary IRA. His total increased tax burden over the ten years would be $970,500.

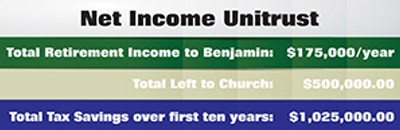

Instead, Pam works with her financial advisor and estate planning attorney to establish a charitable remainder unitrust with her church as the ultimate beneficiary. The CRUT is named as beneficiary of her IRA and so is funded upon her death. The CRUT is set-up as a net income unitrust, allowing Benjamin to defer payments until his retirement. The trust is invested in stocks that do not pay dividends, so the income of the trust is minimal throughout time until his retirement, when he switches to receiving 5% of the trust for the rest of his lifetime.

After ten years of more growth, the beneficiary IRA grows to $3,500,000. Benjamin takes 5% of income starting at his retirement, of $175,000/year. And when he passes away, the church ends up with $500,000 in a total donation as the remainder of what is left in the trust.

These are just a few examples of how a charitable remainder unitrust could be utilized to minimize taxes, maximize charitable donations, and establish an income stream for the beneficiary. For more information, please contact me, talk to your estate planning attorney, or your tax advisor. I can be reached at kcarleton@jrwealth.com

James River Asset Management, LLC, is a Registered Investment Adviser. Securities offered through Valmark Securities, Member FINRA and SIPC.130 Springside Drive, Suite 300 Akron, OH 44333 1-800-765-5201. James River Asset Management, LLC is a separate entity from Valmark Securities Inc. Any opinions expressed here are solely those of James River Asset Management, LLC.

The information provided has been derived from sources believed to be reliable, but is not guaranteed as to accuracy and does not purport to be a complete analysis of the material discussed nor does it constitute an offer or a solicitation of an offer to buy any securities, products or services mentioned. The examples given are hypothetical and are for illustrative purposes. Actual results may vary.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Consult your financial professional before making any investment decision.

DISCLOSURES

The material contained in the ’Market Commentary’ is for informational purposes only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. The information provided has been derived from sources believed to be reliable, but is not guaranteed as to accuracy and does not purport to be a complete analysis of the material discussed, nor does it constitute an offer or a solicitation of an offer to buy any securities, products or services mentioned. Past performance is not indicative of future results. Diversification cannot assure profit or guarantee against loss. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

Bridging where you are to where you want to be through timeless financial advice / Contact us today to get started!

James River Wealth Advisors

15521 Midlothian Turnpike, Suite 100

Midlothian, VA, 23113

Eli's Village

E: inquiry@elisvillage.com

P: (804) 302-0502

Securities offered through J.W. Cole Financial, Inc (JWC) Member FINRA/SIPC. Advisory Services offered through James River Asset Management LLC. James River Wealth Advisors and James River Asset Management LLC are unaffiliated entities of J.W. Cole Financial.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Our site contains hyperlinks to other web sites operated by third parties. These links will take you away from our site. Please note that we do not guarantee the accuracy or completeness of any information presented on these sites.